EMEA remained the strongest-selling region at 46.8% (2023: 44.7%). North America’s sales share decreased slightly from 28.1% to 27.0%, as did the share of the Asia-Pacific region, which changed from 24.2% in the previous year to 22.9% in the year under review. The Region of South America has a sales share of 3.3% (2023: 3.0%).

Transformation on Track

Download

Annual Report 2024 as PDF

Strengthening our strengths and unlocking our potential – ZF plans to continue developing globally as a high-performing and sustainable company with a portfolio focused on profitable growth. More details as well as facts and figures on the 2024 annual financial statements can be downloaded here as a PDF file.

The Most Important 2024 Key Figures at a Glance

The divisions’ sales shares developed as follows:

Touch the segments on the chart to learn more about the development of sales.

Navigating Challenges – Shaping Opportunities

In a dynamic market environment, we systematically advanced our transformation in 2024 and achieved significant milestones. We have refined our corporate structures, optimized our product portfolio and strengthened our organization – with greater autonomy, new partnerships and as a player in a flexible "ecosystem." By leveraging digitalization and networking, we are creating a sustainable system – agile and innovative – and actively shaping the future of ZF.

Strategic Partnerships

Engaging in partnerships and spinning off parts of the company offer enormous potential to unleash existing growth forces while creating the flexibility for targeted investments.

Last year, our Passive Safety Systems Division successfully embarked on its journey towards independence. In its first fiscal year, ZF Lifetec introduced a multitude of innovations in airbag, seat belt and steering wheel systems. With its mission “We save lives,” the new brand aims to make daily mobility even safer and more sustainable. Combining a technology-driven approach with leading innovations, the number 2 in passive safety technology continues to strengthen its competitive position and aims to grow faster than the market. The increased entrepreneurial flexibility as an independent brand now allows for more targeted responses to customer needs. In 2024, ZF Lifetec opened a new research and development center in India and two new plants in China for the production of airbags and seat belts.

System solutions from ZF Lifetec help vehicle manufacturers significantly improve occupant safety.

The market for passive safety systems is less affected by the disruptive developments currently characterizing the automotive industry. According to studies, the total market volume of around 19 billion euros in 2023 is expected to grow by 2030 with a cumulative annual growth rate of around 4 percent. The main drivers of growth are increasing safety regulations and automotive megatrends such as automated driving, electrification and new interior concepts. This opens up additional business areas for ZF Lifetec.

In April 2024, we completed the establishment of our joint venture with Foxconn (Hon Hai Technology Group). Both companies hold a 50 percent stake. ZF Foxconn Chassis Modules (ZFFCN) leads the global market and very successfully leverages the opportunities of e-mobility for the axle business. Despite the current downturn in the automotive market, the newly founded company benefits from attractive growth driven by high order numbers from top manufacturers and the ongoing outsourcing trend. Therefore, ZFFCN expects to double its revenue from the current 4 billion euros to 8 billion euros by 2029, thus bucking the trend. In fall 2024, two new plants in Hungary started pre-production operations for customers in order to strengthen their global presence and tap into new markets. Further new plants are planned, including in North America and China.

The collaboration within the ZF Foxconn Chassis Modules joint venture framework expands ZF’s global footprint, particularly in Asia. It also promotes access to advanced manufacturing technologies and enables the development of innovative chassis solutions for electric vehicles. At the same time, it strengthens our market position by opening up new customer segments.

No other competitor can draw on decades of expertise in the axle business and, at the same time, leverage added momentum and economies of scale from the world’s largest electronics contract manufacturer. Last year, ZF Foxconn celebrated 30 years of axle system assembly and logistics expertise. Since 1994, a total of 40 million axle sets have been produced worldwide.

To further develop and market middleware stacks that are unique in the industry, we have transferred our development cooperation with KPIT Technologies, which has existed since 2021, into the independent software company Qorix. KPIT and ZF each hold an equal share in the newly founded company. Qorix’s open and scalable middleware platforms offer vehicle manufacturers the ability to more easily manage the ever-growing software complexity while maintaining full control over the software architecture.

Strategic partnerships provide us with a crucial competitive advantage in shaping the mobility of tomorrow. This is also demonstrated by our cooperation with Infineon Technologies AG as part of the “EEmotion” project, which was funded by the German Federal Ministry for Economic Affairs and Climate Action. We have enhanced our existing software solutions cubiX and Eco Control 4 ACC by AI algorithms and implemented them on Infineon’s Aurix TC4x microcontroller (MCU) with integrated Parallel Processing Unit (PPU). The result: algorithms based on artificial intelligence are more efficient. They optimize software and control units for driving dynamics systems.

Using Resources Strategically

We use our resources specifically in those areas of the company in which we are particularly strong and successfully positioned. Our success is driven by cutting-edge technologies, innovations and technology transfer. That way we generate additional, profitable growth.

With the broadest range of products and solutions on the market, we are the world’s most successful supplier of commercial vehicle technologies. We have made targeted investments to further expand this leading international position of our Commercial Vehicle Solutions Division. Our success is driven by cutting-edge technologies and innovations, along with our technology transfer strategy. We develop technologies and platforms once and use them across various product segments. This allows us to industrialize innovations faster than our competitors, giving our customers a technological advantage.

We are developing driveline technologies for the commercial vehicle industry of tomorrow.

In fiscal year 2024, we were able to generate numerous new customer orders with our solutions in the areas of chassis technology, safety and decarbonization. We are ascending to become the number one in Europe in the field of electrified driveline technologies for commercial vehicles. The new e-mobility modular drive kit allows manufacturers to configure a drive system tailored to their specific requirements – from medium-duty commercial vehicles to 44-ton trucks. The modular range includes electric motors, matching inverters, a 3-speed transmission and the associated electrical components. This makes the modular kit suitable for the rapid decarbonization of the commercial vehicle industry. The TraXon 2 Hybrid transmission system for heavy commercial vehicles was also newly introduced. Our innovative “TrailTrax” system for the electrification of semi-trailers is attracting growing customer interest as well. The same applies to the cubiX chassis software version specifically developed for commercial vehicles and the new autonomous emergency braking assistant OnGuardMAX, which elevates the standard of active safety in commercial vehicles.

Our Industrial Technology Division is one of the top 3 global players. We are one of the main suppliers of gearboxes in the global wind power industry, with a market share of around 25 percent. This means we are contributing directly to the transition of the energy sector to renewable power generation. In the growth market of India, we are on our way to becoming the leading provider. Around 50 percent of the wind turbines installed there are already operating with ZF products. Last year we reached a milestone of 50 gigawatts. We anticipate a doubling over the next five years. India currently has the fourth largest installed wind power capacity in the world, with around 47 gigawatts. It is expected to grow to 140 gigawatts by 2030. This requires an annual capacity increase of 10 gigawatts.

100 years ago, transmissions laid the foundation for our company and have been integral to our unique strategy of technology transfer. In 1924, ZF adapted the “Soden Transmission TS18.5,” originally developed for passenger cars, for use in railcars. Even today, we can impress our rail customers by transferring innovative driveline technologies from other areas of application. This establishes us as the preferred technology partner worldwide for making rail mobility more efficient, safer and more sustainable. For example, our new EcoWorld 2 rail transmission can reduce fuel consumption by up to 20 percent. The new digital condition monitoring system “connect@rail” detects damage to the driveline and track infrastructure at an early stage, enabling efficient maintenance.

Efficiency and sustainability are also the focus of our innovations for marine applications. With the new ZF 3000 NRD PTI hybrid transmission, we are extending our expertise for maritime drives to another field of ap?plication. We offer a space- and weight-saving solution for realizing hybrid propulsion in waterjet vessels. This enables low-noise and low-emission operation in ports and bays, for example. Initial customer projects have already been successfully implemented. Since last year, patrol boats and firefighting vessels in Asia have been operating reliably with our new hybrid transmission.

Regardless of how future mobility evolves, the chassis remains the basis of every vehicle, providing the foundation for driving dynamics, comfort and safety. As a leading supplier in the chassis sector, we already ensure comfort and driving safety in millions of vehicles worldwide with our steering, braking, damping and stabilization systems along with our overarching control software.

The transformation to electric mobility, automated driving and software-defined vehicles also has an impact on the chassis of passenger cars, though. Wheel guidance, damping, steering and braking are becoming even more significant as fundamental changes are taking place in the electric and electronic architecture of new and future vehicle platforms, among other things. In the software-defined vehicle, driving dynamics are increasingly enhanced by the higher-level coordination and interaction of actuators, rather than just by optimizing individual actuators. Comprehensive systems expertise is required here. This is exactly what we have maximized and perfected with our new Chassis Solutions Division.

The division was created in January 2024 by merging the ZF Car Chassis Technology and Active Safety Systems divisions. Since then, the new division has become a global leader in the chassis sector. It offers a portfolio that is unique in the industry, including hardware and software solutions for all dimensions of driving dynamics (longitudinal, lateral and vertical dynamics). This strategy has already achieved notable success within the first year: For example, the innovative active damping technology sMOTION, which significantly improves vehicle comfort and dynamics, was first introduced in series production in premium models of a renowned German sports car manufacturer.

As a technology leader, ZF also has the industry’s largest portfolio of by-wire technologies that operate without direct mechanical connections or system fluids. Customer interest is high. Our innovative steer-by-wire system is already featured in a vehicle from a North American manufacturer and will go into series production in 2025 with the new premium model ET9 from our Chinese customer NIO. The ET9 is the first model with steer-by-wire technology to receive approval for mass production in China.

Recently, the Group announced the acquisition of an important large order, which – in addition to numerous other chassis products – also includes a brake-by-wire system. Nearly five million vehicles from a leading global vehicle manufacturer will be equipped with this innovative electro-mechanical braking technology from ZF.

Our Aftermarket Division is also experiencing growth – it is the number 2 in the global spare parts and service business. With a range of new products and innovative solutions, we are setting new standards when it comes to creating value for our customers and the development of a circular economy. This further strengthens our leading position.

We give our customers an uptime promise: With proactive maintenance solutions, extended diagnostic functions and continuous support, we want to minimize downtime for our customers and increase productivity at every step. With ZF [pro] Diagnostics, for example, we offer a new, comprehensive diagnostic solution for passenger cars and commercial vehicles of all fuel types in Europe. Workshops, tire service centers and fleets can identify problems quickly and precisely. This saves valuable time and resources. In addition, we are introducing ADAS technology at OE level to the free spare parts market, along with the appropriate calibration equipment to handle the advanced systems.

With the introduction of our new ZF REMAN label, we are enhancing the visibility of remanufactured products. It reflects the increasing significance of sustainability for customers in the automotive aftermarket. At the same time, with CorExpedia we offer our customers an even more streamlined process for the return logistics of used parts. This is an online platform originally developed for the return of parts of the product brand WABCO in Europe. We are now gradually rolling out CorExpedia for the entire ZF Aftermarket portfolio – an important step towards a functioning, sustainable circular economy.

Design for Sustainability

ZF is already focusing on resource conservation and circular economy in product development. The new “Design for Sustainability” directive defines the requirements for components to enable reprocessing. The aim is to give as many products as possible a “second life.” For example, we use more corrosion-resistant materials and new joining technologies that enable damage-free disassembly. This allows us to also return vehicle parts to the material cycle that cannot be economically reprocessed yet. One example of a new product generation designed according to the “Design for Sustainability” guidelines is the third generation of the iABS trailer anti-lock braking system from WABCO. Among other things, it has better access to the printed circuit board, which is now also “reflashable.”

Shaping the Future

We want to actively shape the future of technology for mobility and industry. Our aim is to provide the impetus for the success of tomorrow and to sustainably convert today's potential into tomorrow's competitive advantages.

Our ambitious goal is to become climate-neutral through 2040 across all emissions categories. As we get there, we are working consistently on reducing the CO2 emissions in our production plants and, where possible, eliminating them entirely. This enabled us to reduce CO2e emissions by 51 percent compared to 2019, and we are focusing on decarbonizing our supply chain and products in Scope 3. Through late 2025, all plants should be powered entirely using green electricity. In addition, we are expanding renewable energy to generate our own electricity and supply heat on a more sustainable basis. With solar systems, the plants can cover part of their annual electricity needs. Climate-neutral heat pumps are replacing the previous heating systems powered by fossil fuels. A blueprint for all existing and new plants is our factory in Klášterec (Czech Republic). It went into operation last year with a comprehensively decarbonized energy system.

The digital transformation in production is also progressing. More than 60 plants with more than 7,000 machines are already connected to the Digital Manufacturing Platform (DMP) with a central cloud solution. The cross-plant integration and easy scalability of the DMP make us independent of local infrastructure. The result is lower production costs, optimized inventories, increased production performance and quality as well as more efficient personnel planning. Optimized production processes prevent rejects while improved machine run times reduce energy consumption. The plan is to connect all plants to the DMP by 2026.

The plan is to connect all plants to the DMP by 2026.

In Germany, we have opened up a new, additional growth area with the extension of the portfolio of ZF Test Systems to include test benches for batteries. Here, vehicle manufacturers and service providers can test and certify their batteries for electric vehicles – from the cell, to the module, right through to the pack. Given the large demand, we are now going to further expand these test benches in Passau. Overall, the Test Systems business area is performing very well and will develop additional growth poten?tial with the future international ramp-up of electric mobility. ZF product segments also benefit from this internal testing expertise through a high level of quality assurance, for example, for vibration-free and low-noise electric axles.

In growth regions such as Asia-Pacific, India and North America, we are expanding our local-for-local activities. The aim is to benefit from the dynamic markets there, grow sustainably and secure new customers.

Last year for instance, we opened our third production plant for electric powertrain technologies in China, currently the world’s largest electric vehicle market. China has developed over decades into a major production and development location for ZF in the Asia-Pacific area. For our advanced ADAS systems, we were the first foreign automotive supplier to obtain a Level 4 test license for highly automated driving in Shanghai.

ZF sets standards in China: Level 4 test license for highly automated driving in Shanghai.

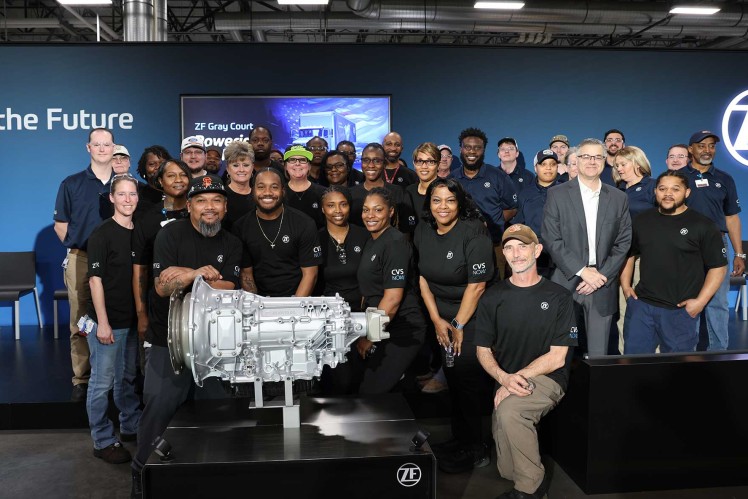

In North America, we are strengthening our competitiveness by localizing hybrid transmissions at our Gray Court plant in the U.S. and a new R&D center in Monterey, Mexico. The plant in Gray Court, South Carolina, is being converted for the flexible production of conventional and electric drives for passenger cars and commercial vehicles. Production of the 8-speed automatic transmission, which is also suitable for plug-in hybrid vehicles, will begin in 2025. Production of the hybrid-capable PowerLine transmission for medium-duty trucks, buses and pick-ups has already started. Our ramp-up plans already foresee up to 200,000 PowerLine units for 2025. German plants also benefit from this success story. For example, the mechatronics modules come from Saarbrücken and the electronic control units from Auerbach. With the expanded production capacities, we will be able to respond even more flexibly to the wishes of North American customers and the increasing demand for hybrid drives in the future.

ZF sets standards in China: Level 4 test license for highly automated driving in Shanghai.

The new ZF Campus in Monterey strengthens Group research and development of advanced technologies for electric and autonomous vehicles. The portfolio ranges from software, cybersecurity and algorithms to electric motors. The Campus also has 16 state-of-the-art laboratories that can simulate real-world conditions.

New ZF Campus Monterey: Research and development of new technologies for electric and autonomous vehicles.

India is one of the world’s biggest growth markets. Alongside renewable energies, the market for electric mobility is also growing fast. By 2030, the share of electric vehicles is to rise to 30 percent for passenger cars and to as much as 70 percent for trucks and buses. The ZF Commercial Vehicle Solutions and Industrial Technology divisions take advantage of these growth opportunities and further expand their local production.

Headquarters of ZF India in Pune.

As the pacesetter of commercial vehicle technology and facilitator of the rapid decarbonization of delivery traffic, ZF opened a new plant in Oragadam (Tamil Nadu Province) last year, where the production of brakes and chassis components started. In a second phase, the plant will be expanded to include the prouction of electric components such as air compressors for light and medium-duty commercial vehicles.

The Industrial Technology Division invested in a new production plant in Coimbatore to localize the ERGOPOWER M transmission series. Together with the main location in Friedrichshafen (Germany), the new plant in India will create the necessary production capacities for future market growth in the Indian and global construction machinery market.

Today, ZF has a total of approximately 30 production and development locations on the Indian subcontinent. Local production is an important success factor in the long-term growth strategy. It makes it possible to meet customer demand and expectations more flexibly and provide them with easy access to our world-leading technologies with local manufacturing expertise. It also helps to avoid import duties and eliminate transport costs.